The Money Printer's Tale: How M2 Supply Shapes Global Economics and Crypto Markets

Ever checked your bank statement and wondered why your money buys less than last year? It's not your imagination. While you've been living your life, central banks worldwide have quietly created trillions of dollars from nothing. This isn't conspiracy talk - it's standard monetary policy, and understanding it might help you protect your wealth in coming years.

Here's the kicker: what hurts your dollar could actually boost bitcoin and other digital assets. As global liquidity grows and more money floods the financial system, bitcoin typically rises alongside M2 supply growth, with previous bull markets coinciding with periods of increased global liquidity. But before diving into that fascinating correlation, let's unpack this economic force that few outside financial circles truly grasp.

What Is M2 Money Supply (And Why Should You Care?)

Money exists in different forms, like water in different states. M1 is the cash in your wallet and checking account - money you can spend immediately. M2 includes all of M1 plus your savings accounts, money market funds, and other "near-money" that quickly becomes spendable.

The crucial point: unlike gold or bitcoin, central banks can expand M2 whenever they want. When the Federal Reserve aims to stimulate the economy, they essentially fire up the digital money printer, creating new currency that pours into the banking system.

For perspective, in February 2020 (pre-pandemic), U.S. M2 money supply was about $15.5 trillion. By December 2021, it had swelled to nearly $21.6 trillion - a staggering 40% increase in under two years. That's like adding Japan's entire wealth to the U.S. economy overnight.

The Economic Chess Match: How M2 Becomes a Weapon in Trade Wars

Current tensions between the US and China showcase how money supply becomes a strategic weapon. In April 2025, President Trump hiked tariffs on Chinese goods to a massive 125%, bringing the total US tariff on some Chinese imports to 145%, claiming Beijing showed "lack of respect for global markets." China quickly hit back with counter-tariffs.

This economic chess match typically unfolds like this:

- Country A slaps tariffs on Country B's exports

- Country B devalues their currency by expanding their M2 money supply

- This devaluation makes Country B's exports cheaper again, partly neutralizing the tariff

- Country A responds by expanding their own M2 to keep their currency from becoming too strong

It's high-stakes economic chess, with citizens of both countries caught in the middle as inflation eats away their purchasing power. According to a recent CNBC survey, most respondents believe Trump's trade war will trigger a global hunt for low-tariff regimes, with recession being the expected outcome for 63% of those surveyed.

During previous trade tensions, China let the yuan fall beyond the psychologically important 7:1 ratio against the dollar. This wasn't random - it was calculated to offset much of the tariff impact. The current situation is even more intense, with China dismissing Trump's latest moves as a "joke" and imposing their own 125% tariffs on US goods.

The Hidden Tax Nobody Elected

When central banks expand M2, they're essentially watering down the value of every dollar, yuan, or euro already in circulation. It's like a company issuing new shares - existing shareholders get diluted.

Imagine having $100,000 saved, and the M2 supply grows by 20% in a year. All else equal, your purchasing power just dropped to about $83,333. That's a 16.7% tax nobody voted for, affecting everyone holding that currency.

During 2020-2021, when M2 expanded by roughly 26% annually in the U.S., anyone holding cash lost over a quarter of their purchasing power in just two years. No wonder housing, stocks, and cryptocurrencies skyrocketed as people sought refuge from this invisible wealth erosion.

The Bitcoin Connection: Why Crypto Investors Track M2 So Closely

This is where things get interesting for our crypto community. Bitcoin was created specifically to counter unlimited money printing. With its capped supply of 21 million coins and predictable issuance schedule, bitcoin stands opposite to fiat currency's unlimited supply potential.

This fundamental difference creates a fascinating correlation between M2 expansion and bitcoin prices. Consider these historical examples:

Case Study 1: The 2020-2021 Bull Run

- U.S. M2 grew from $15.5T to $21.6T (40% increase)

- Bitcoin price rose from about $8,000 to $69,000 (762% increase)

Case Study 2: The 2017 Bull Run

- U.S. M2 grew from $13.2T to $13.8T (4.5% increase)

- Bitcoin price rose from $1,000 to nearly $20,000 (1,900% increase)

Case Study 3: The 2023-2024 Recovery

- After aggressive interest rate hikes slowed M2 growth in 2022, bitcoin initially crashed

- When markets anticipated a return to monetary expansion in 2023, bitcoin bounced back

- Bitcoin continued climbing through 2024, rising from around $42K in early 2024 to over $100K by early 2025, alongside rising M2 levels

These aren't perfect correlations - many factors drive crypto prices - but the pattern seems clear: when central banks print, bitcoin often soars.

The relationship makes sense. As more currency units chase the same amount of goods and services, prices rise. Assets with fixed or predictable supply, like bitcoin, become especially attractive as inflation hedges.

Reading the Signs: What Current M2 Trends Mean for Crypto

So where do we stand now, and what does it mean for your crypto investments?

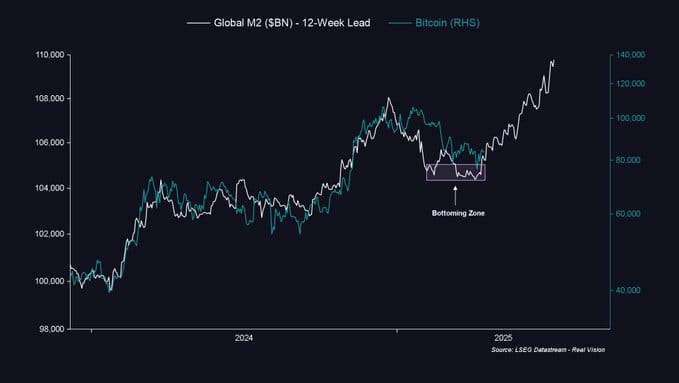

As of April 2025, global M2 money supply has reached an all-time high of $108.4 trillion, amid growing economic uncertainty following Trump's tariffs and China's swift retaliation, which together have unsettled global markets. This milestone matters for bitcoin investors, as BTC has historically shown strong correlation with M2 supply levels.

Looking at current trends, experts point to a remarkable and consistent correlation - often exceeding 84% - between bitcoin price and global M2 liquidity levels. When liquidity expands across the global economy, bitcoin typically moves upward, though usually with a noticeable lag.

Based on these trends and historical patterns, here's what might happen next:

- With global liquidity continuing to expand, analysts predict a significant initial rally for bitcoin and other digital assets, potentially lasting until mid-May

- If the ongoing trade war pushes China to further expand its money supply while the U.S. follows suit to stay competitive, we might see bitcoin testing new all-time highs, with some models suggesting $108,000 by June 2025

- The correlation between bitcoin and M2 supply creates potential investment opportunities as global liquidity expands, with the M2 money supply showing sharp increases since late 2024

Beyond Bitcoin: How Different Cryptos Respond to Monetary Expansion

While bitcoin has the clearest narrative as "digital gold," different cryptocurrencies respond differently to M2 expansion:

- Bitcoin: The purest play on monetary debasement, typically shows the strongest long-term correlation

- Ethereum: Responds to M2 expansion but is also influenced by its own supply dynamics and ecosystem growth

- DeFi tokens: Often benefit from the "risk-on" sentiment that accompanies monetary expansion

- Stablecoins: Ironically, see increased utility during high inflation as people seek dollar exposure in regions with even worse currency debasement

This variance creates opportunities for building portfolios that can capitalize on monetary policy shifts in sophisticated ways.

The Money Illusion: Why Most People Miss This Relationship

Most investors suffer from what economists call "money illusion" - they track their wealth in nominal currency terms rather than purchasing power. This mental blind spot keeps them from seeing the effects of M2 expansion until too late.

Think about it: if your portfolio grew 15% last year while M2 expanded by 20%, you're actually poorer in real terms, despite feeling richer looking at your account balance.

Crypto investors have an edge here. The community's obsession with understanding monetary fundamentals means they're often first to recognize and act on these trends. While conventional investors celebrate nominal gains, crypto investors position themselves for the next wave of monetary response.

Your M2 Survival Guide: Practical Steps for Different Investors

Depending on your crypto knowledge and risk tolerance, here are actionable steps to navigate the M2 landscape:

For Crypto Beginners:

- Start by putting 1-5% of your portfolio in bitcoin as an inflation hedge

- Set up automatic monthly purchases to dollar-cost average through volatility

- Study the relationship between Fed announcements and crypto market movements

For Experienced Crypto Investors:

- Consider increasing allocation during periods of accelerating M2 growth

- Diversify across cryptoassets with different monetary response patterns

- Use blockchain analytics to identify smart money flows following major central bank announcements

For Sophisticated Investors:

- Explore options strategies that gain leverage to bitcoin during rapid M2 expansion

- Consider multi-currency exposure to arbitrage different national monetary policies

- Investigate DeFi protocols that offer innovative inflation protection mechanisms

The Great Wealth Transfer: Being on the Right Side of Monetary History

I've come to see expansionary monetary policy not as good or bad, but simply as a reality of our current financial system. The question isn't whether it will happen, but who will benefit when it does.

Throughout history, periods of significant monetary expansion have created massive wealth transfers. Those holding dilutable assets (cash, bonds) lose purchasing power, while those holding scarce assets (land, gold, and now bitcoin) tend to gain.

The beauty of our current moment is that, perhaps for the first time in history, average people can position themselves on the beneficial side of this wealth transfer with relatively small investments in cryptocurrency. You don't need political connections or vast capital - just understanding and conviction.

The Money Printer's Double-Edged Sword

That "Money Printer Go Brrr" meme in crypto circles gets a laugh because it boils down something complex into something simple. But beneath the joke lies a brutal truth: today's monetary policy barely resembles anything from most of human history.

The weird thing about all this money creation? The very tools governments use to prop up short-term economic stability might be the exact things pushing people toward bitcoin long-term. Even with the US and China slinging tariffs at each other like angry neighbors, bitcoin hasn't collapsed – quite the opposite. Some analysts point out that despite "bitcoin's recent wild swings reflecting economic jitters and shifting trader positions, the king of crypto isn't even close to bear territory."

When you watch this US-China tariff battle ramp up to levels nobody thought possible, remember both sides will likely crank up their money printers as part of their strategy. Every time they do, it just makes bitcoin's fixed supply more appealing. With each round of money creation, we inch closer to a world where having something with actual scarcity matters more than ever.

Whether you've been in crypto for years or just bought your first fraction of bitcoin last week, seeing this connection gives you a huge advantage in both understanding policy moves and planning your investments. While your neighbors scratch their heads wondering why everything costs more despite their bigger paychecks, you'll be riding the wave those money printers create.

Like they say downtown: "History doesn't repeat, but it sure as hell rhymes." In the long beat of monetary history, the early birds have always eaten best.

WANT TO LEARN MORE? LET'S TALK!

I manage a private crypto fund that works with accredited and institutional investors. If you’re considering exposure for your portfolio, looking to learn more, or exploring strategic partnerships as an allocator or advisor, I'd love to connect!

🚀 Send me an email or a message on LinkedIn.

This article represents my personal views and not formal investment advice. All investments carry risk, and past performance is not indicative of future results. Please do your own research before making any investment decisions.